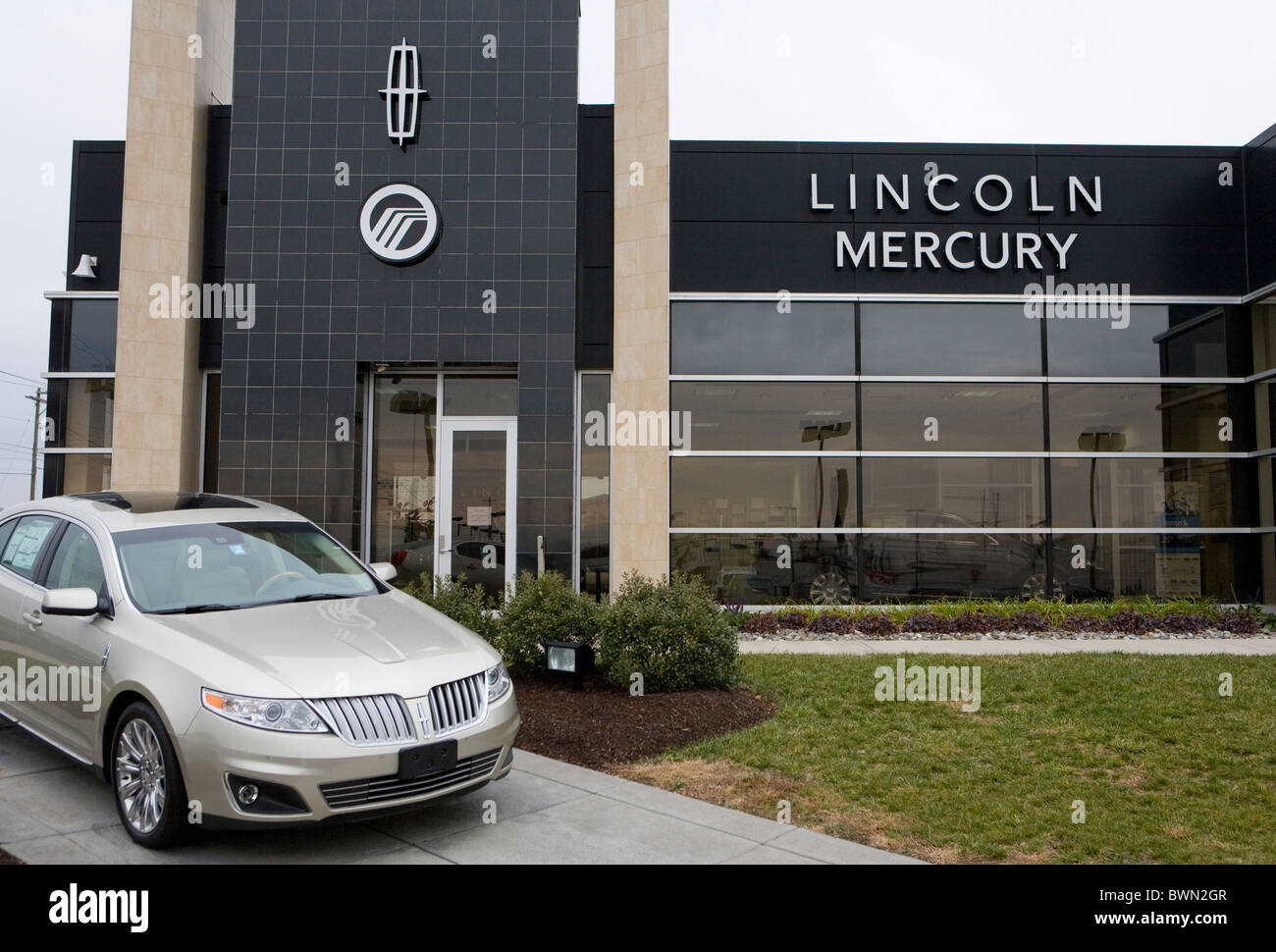

Explore Lincoln Dealerships: Varsity Lincoln Attracts Attention

Explore Lincoln Dealerships: Varsity Lincoln Attracts Attention

Blog Article

Mastering the Art of Negotiating Reduced Rates on Auto Leasing Agreements Like a Pro

In the realm of auto leasing agreements, the capacity to work out reduced prices can substantially influence the overall expense and regards to your lease. It requires a critical strategy, understanding of the marketplace, and a certain level of skill. As customers, we commonly overlook the power we hold in shaping the regards to our arrangements, assuming that the terms provided are non-negotiable. Nevertheless, understanding the art of working out reduced rates on cars and truck leases can not just conserve you cash but likewise give you with a better understanding of the leasing process all at once.

Understanding Your Leasing Contract

Moreover, recognizing the depreciation timetable outlined in the agreement is important, as it directly affects your monthly settlements. Devaluation is the difference in between the cars and truck's preliminary worth and its anticipated value at the end of the lease, separated by the lease term. This understanding empowers you to bargain a lower monthly settlement by targeting a higher residual worth or challenging filled with air depreciation price quotes. Eventually, a clear comprehension of your leasing contract equips you with the understanding needed to discuss much more properly and protect a favorable bargain.

Researching Market Rates and Trends

To properly bargain lower rates on cars and truck leasing arrangements, it is important to conduct extensive study on current market rates and patterns. Looking into market prices involves comparing the expenses of comparable lease agreements used by various dealerships or leasing business. By comprehending the ordinary prices on the market, you outfit on your own with valuable knowledge that can be utilized as take advantage of during settlements.

Furthermore, remaining educated about market patterns is important. Factors such as the demand for details automobile versions, the state of the economic climate, and also the time of year can influence leasing rates. Tracking these trends can aid you prepare for when prices are most likely to be a lot more favorable and time your negotiations accordingly.

On-line sources, market magazines, and also conversations with sector experts can give valuable insights into current market rates and trends. By arming yourself with this knowledge, you can approach negotiations with confidence and enhance your opportunities of safeguarding a reduced rate on your vehicle leasing arrangement.

Leveraging Your Credit Rating

By recognizing exactly how your credit rating rating influences leasing prices and terms, you can strategically utilize this financial facet to potentially bargain much better terms on your automobile renting agreement. When figuring out the rate of interest price and terms they provide you, your debt score offers as a vital element that leasing companies take into consideration. A index higher debt score commonly represents to lending institutions that you are a lower-risk customer, which can lead to a lot more desirable leasing terms. To take advantage of your credit report efficiently, begin by inspecting your debt record for any errors that could be negatively impacting your score. Take steps to enhance your credit score by making prompt settlements, maintaining credit scores card equilibriums low, and staying clear kia inventory of opening brand-new lines of credit prior to entering into a vehicle leasing agreement. By demonstrating responsible credit rating actions, you can enhance your negotiating position and potentially safeguard a reduced rates of interest and extra positive terms on your automobile lease.

Discussing With Confidence and Knowledge

With a detailed understanding of the cars and truck leasing process and armed with knowledge of market prices, you can confidently work out favorable terms for your lease agreement. Begin by investigating present leasing promotions and rewards supplied by car dealerships. These can offer a standard for the rates you should intend for during arrangements. Familiarize on your own with common leasing terms such as cash factor, residual worth, and capitalized cost to ensure you are well-appointed to discuss these elements with the leasing representative (lincoln continental).

Moreover, be prepared to leave if the terms are not to your liking. Demonstrating a determination to check out various other choices can usually motivate the renting firm to offer more attractive rates to secure your organization. Furthermore, utilize any commitment programs or discounts you may be qualified for to even more boost your discussing setting.

Exploring Alternate Leasing Options

If you're satisfied with your present lorry and its problem, expanding the lease can be an easy means to continue driving the visit this website exact same car without the headache of returning it and discovering a brand-new one. Furthermore, you can take into consideration a lease acquistion where you acquire the car at the end of the lease.

Verdict

The leasing arrangement offers as a legitimately binding agreement in between you, as the lessee, and the renting firm, outlining the terms of the lease, including monthly payments, mileage limits, maintenance obligations, and prospective charges. Devaluation is the distinction between the automobile's first value and its expected value at the end of the lease, divided by the lease term. Investigating market rates includes comparing the prices of comparable lease arrangements supplied by various dealerships or renting companies (varsity lincoln).By recognizing how your credit report rating affects leasing prices and terms, you can tactically take advantage of this monetary facet to possibly work out far better terms on your car leasing contract. In a lease requisition, you presume the remaining lease term and payments of someone looking to get out of their lease early

Report this page